Credit Cards

Aqua Classic Credit Card review: Build credit!

From its 60-second application process to its unique features for individuals with low credit scores, discover if this card is the right fit for your financial journey!

Advertisement

Read the Aqua Classic Credit Card review and learn everything about it!

Navigating the vast landscape of credit cards can be a daunting task, but fear not—our comprehensive Aqua Classic Credit Card review is here to guide you through the intricacies of this card.

Moreover, tailored to meet the needs of individuals with varying credit histories, the Aqua Classic Credit Card has gained prominence for its accessibility and unique features.

| Card’s Highlights 🔍 |

|---|

| No annual fee to enjoy this card’s benefits! |

| 34.90% representative variable APR; |

| £250 – £1,500 that adjust as they get to know your way to deal with credit; |

| This card has no rewards, but you can check your credit score for free. |

Aqua Classic Credit Card features: how does this card perform?

The Aqua Classic Credit Card has carved a niche for itself in the credit card market by extending a helping hand to those with less-than-perfect credit scores.

Our review will provide you with an in-depth analysis of the card’s application process, shedding light on its quick and user-friendly nature.

We’ll explore the nuances of the credit limits, the 24/7 fraud protection, and the potential APR considerations.

Weigh the pros and cons: should you get the Aqua Classic Credit Card?

You can use this incredible card to help you build credit and get many perks related to this. Moreover, the application process is quick and won’t hurt your score.

However, this card also has some downsides. Therefore, you can read below to see the pros and cons!

Strengths and advantages:

- With this card, you’ll be able to get 24/7 fraud protections to keep your card safe;

- You’ll be able to have a quick application process that can be finished in as little as 60 seconds;

- Your credit score won’t suffer an impact when you start the application process;

- Build credit with this card and improve your financial situation while making your everyday purchases;

- You can get a good credit limit with this card that ranges from £250 to up to £1,500, depending on your credit card usage;

- You’ll be able to get text alerts when a payment is due on your credit card.

Pay attention to some drawbacks:

- The representative APR can be really high (37.90% variable);

- If you get the highest APR possible, it will be as much as 49.90% (variable);

- This credit card offers no rewards programs or welcome bonuses.

Eligibility requirements: who can apply for the Aqua Classic Credit Card?

If you need a credit card to help you build credit, this can be the right one! Therefore, you won’t need to worry about your credit score when you apply for this card.

Also, there are other eligibility requirements:

- You need to be at least 18 years old;

- You’ll need to have a permanent UK address;

- You can’t have registered bankrupt in the past 18 months;

- You’ll need a bank account;

Aqua Classic Credit Card application process: the pathway to your new card!

So, to apply online for this card, you’ll need to go to the official website online and click on the page to Check your Eligibility.

Then, you’ll be able to complete the eligibility process in as little as 60 seconds.

After that, you’ll need to complete the application process by providing more personal information and documents.

You’ll be able to use the Aqua mobile app to manage all your credit card features. However, you’ll need to go to the official website to complete the application process.

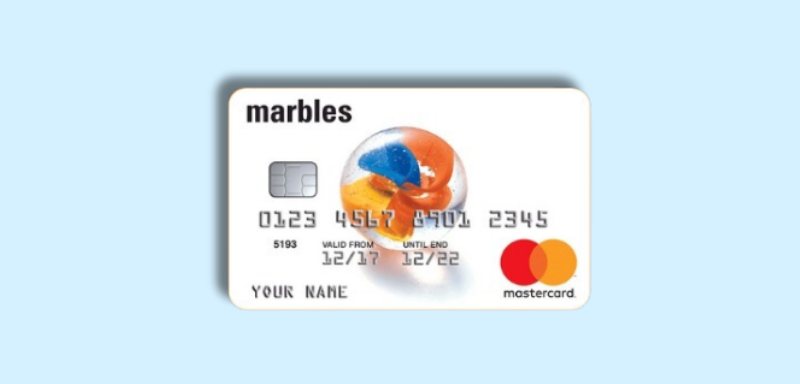

Compare to conquer: is the Marbles Credit Card a better pick for you?

Are you looking for a credit card with similar features? If so, you can try applying for the Marbles Credit Card. Moreover, with this card, you’ll be able to build your credit score too!

Also, you’ll be able to get a credit limit of up to £1,500, depending on your financial situation and card usage.

In addition, this card can help you get 56 days interest-free to help you save money on purchases.

Therefore, you can read our full review to learn more about how this card works and see which card can be the best option for your financial needs!

Marbles Credit Card: No annual fee!

See our Marbles Credit Card review to learn how you can use it to build your credit score and manage your finances with ease!

Trending Topics

Everyday Loans Review: Up to £15000!

Find out about Everyday Loans' commitment to inclusivity and customer satisfaction. Explore their range of financial products!

Keep Reading

RBS Personal Loan Review: A Loan That Bends to Your Needs!

Explore the benefits of the RBS Personal Loan—flexible terms, no origination fees, and more. Borrow up to £50,000 for your personal needs.

Keep Reading

M&S Bank Rewards Credit Card: Earn while you shop!

Unleash the perks of the M&S Bank Rewards Credit Card—your golden ticket to rewards, travel treats, and top-notch rates.

Keep ReadingYou may also like

Tesco Bank Balance Transfer Credit Card review: Long intro period!

Considering the Tesco Bank Balance Transfer Credit Card? Dive into our blog for a comprehensive overview. Discover its perks!

Keep Reading

Aqua Advance Credit Card: No Annual Fee!

Unlock financial empowerment with our in-depth Aqua Advance Credit Card review! Discover its benefits and potential drawbacks!

Keep Reading

Santander All in One Credit Card: Cash Back Like a Boss!

Discover the Santander All in One Credit Card, a powerhouse of perks with unlimited cashback and rewarding features for savvy spenders.

Keep Reading