Credit Cards

HSBC Student Credit Card review: start your credit journey

Find out all about the HSBC Student Credit card in this helpful review. Check out the rates, fees and benefits provided.

Advertisement

Start your financial life with this student credit card from HSBC

Student life can be very tough and time-demanding, with all the exams, deadlines, and assignments. On top of that, tuition! To help deal with all that, the HSBC Student Credit Card may come in handy.

Managing your bank account may play an important role while you go to uni. So a student credit card with no annual fee and a purchase rate of 18.9% p.a. makes sense for the situation.

Take a look at the card’s highlights and keep reading this review to see what else this financial tool has to offer.

| Card’s Highlights 🔍 |

| Credit limit up to £500, depending on status. |

| Go digital with the HSBC UK Mobile Banking app and check balances whenever you wish. |

| No annual fee. |

| Worldwide use, as long as you’re on a Visa or Mastercard network covered location. |

| It has an annual percentage rate of 18.9%, being variable, with no introductory rate. Monthly, the rate is of 1.456%. |

| Since it is a product for students, there are no rewards provided, unlike other HSBC credit cards. |

How does the HSBC Student Credit Card perform?

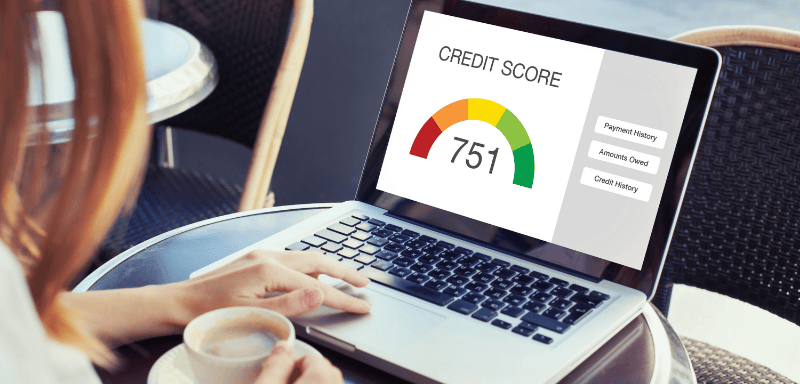

This is a wise option for building a credit history and getting by unexpected expenses along your student path.

By offering lower rates and zero annual fees, the Student Credit Card from HSBC could become a helping hand.

Student life could get less stressful once you have a suitable credit card to help you out. Uni is a great time to focus on building independence, so getting the HSBC Student Credit Card may be a good call.

Weigh the pros and cons: Should you get the HSBC Student Credit Card?

There may be some pros and cons when it comes to choosing a financial product. Especially if you are at the beginning of your career, focusing on studies and dealing with tuition.

Therefore, check out a few strengths and drawbacks we selected about the HSBC Student Credit Card :

Strengths and advantages:

- No annual fee

- Contactless card

- Use it on your mobile digital wallet

- Purchase rate of 18.9% p.a., which is lower than usual.

- While traveling, you can use it in all countries and regions supported by Visa and Mastercard networks.

- Purchase protection

- Check your balance and payments on the HSBC Mobile banking app

Pay attention to some drawbacks:

- If you already hold another HSBC credit card, you will not be eligible for this one.

- Costumers have to be enrolled in one of the qualifying higher education UK courses cited on the HSBC Student Bank Account website. This means that abroad courses won’t fit the criteria.

- Up to £500 credit limit, which could be lower than your needs, depending on your situation.

- Since it is a product for students, there are no rewards and discount offers provided, unlike other HSBC credit cards.

Eligibility requirements: Who can apply for the HSBC Student Credit Card?

As the name suggests, applicants have to be enrolled in one of the qualifying courses listed on the HSBC Student Bank Account website.

In addition to that, to apply, you should be over 18 years old and also either a UK, Channel Islands or Isle of Man resident for at least the past 3 years.

The pathway to your new HSBC Student Credit Card: application process

Thinking about applying? The path to it is quite simple: once you hold an HSBC Student Bank Account, you can apply for your card on the official HSBC Mobile banking app or online on their website.

Download the app on your smartphone application store. After logging in, simply hit the “apply in app” button and follow the instructions!

You can also do your application process in one of the branches near your location, in case you prefer face-to-face assistance.

Compare to conquer: Is the HSBC Classic Credit Card a better pick for you?

However, perhaps a higher credit limit suits your lifestyle better. Or maybe you are not a student at the moment. If that’s the case, you could make better use of some other options from the HSBC range.

How about the HSBC Classic Credit Card? Enjoy the smart combination of zero annual fees and a discount program.

Find out how to apply for your HSBC Classic Credit Card on the review we prepared on the link below!

HSBC Classic Credit Card review: discount program!

Find out all about the HSBC Classic Credit Card's features, usability, and benefits in our review. Click here to learn more!

Trending Topics

How Credit Utilisation Impacts Your Credit Score (And How to Fix It)

Learn what credit utilisation is, why it matters, and how it affects your UK credit score — plus simple tips to improve it fast.

Keep Reading

Shawbrook Personal Loan Review: Freedom at Your Fingertips

The opportunity to access that money to rescue your budget. Shawbrook Personal Loan is what you need; now, discover all about it

Keep Reading

If Your Life Feels Like A Mess, Read This – Achieve A Stress-Free Organized Life

Struggling with stress and chaos? Discover how to create a stress-free organized life with simple habits that bring balance, and peace.

Keep ReadingYou may also like

Moneyboat Loans Review: Quick Cash Without the Headache

Moneyboat Loans: Get fast cash with flexible repayment terms from 2 to 6 months. No perfect credit score required.

Keep Reading

Barclaycard Forward Credit Card Review: 0% intro on purchases!

Uncover the pros and cons of the Barclaycard Forward Credit Card – from scheduled rate reductions to exclusive event discounts!

Keep Reading

Barclaycard Avios Card Review: No annual fee, just travel rewards

Explore the Barclaycard Avios Card UK and discover how to turn shopping into travel rewards. Ideal for frequent flyers who love rewards.

Keep Reading