Credit Cards

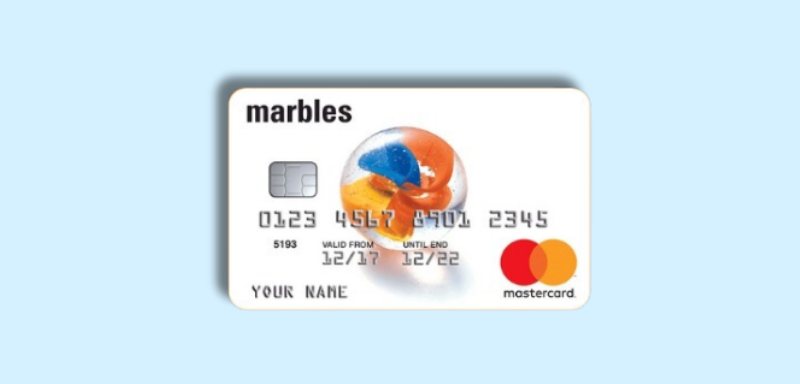

Marbles Credit Card: No annual fee!

Discover the perks and pitfalls of the Tesco Bank Foundation Credit Card in our comprehensive review and use this card to keep track of your finances!

Advertisement

Looking for a new credit card? Check the Marbles Credit Card!

Are you in search of a credit card that offers accessibility and flexibility while helping you build or rebuild your credit history? Look no further than the Marbles Credit Card.

In today’s financial landscape, finding a credit card tailored to individuals with limited or poor credit history can be challenging. That’s where Marbles steps in, offering a solution designed to empower individuals on their journey to financial health.

| Card’s Highlights 🔍 |

| You’ll have a chance to qualify for this card even with a limited credit score. |

| There is a 56-day maximum interest-free if you pay your balance in full each month; There is no annual fee; Up to 3% of the balance transfer money transfer (minimum £3); 5% of each cash transaction (minimum £3). |

| This card has a 34.90% representative variable APR. |

| This card doesn’t offer any regular rewards or a welcome bonus. |

Marbles Credit Card features: how does this card perform?

One of its most appealing features is that it accepts customers with poor or no credit history due to its lenient qualifying requirements.

Also, this inclusion is especially beneficial for people who would have had difficulty obtaining credit elsewhere since it provides them with opportunities for progress and access to essential financial tools.

Additionally, potential applicants would feel more at ease knowing that they can easily verify their eligibility with the Marbles Credit Card without jeopardizing their credit score.

Moreover, the Marbles Credit Card provides its holders with flexibility and convenience in addition to accessibility.

Therefore, cardholders may easily manage their repayments by selecting a payment date that works for their budget and having the flexibility to adjust it up to twice a year.

What about its costs?

The card’s lack of annual or monthly fees further enhances its allure by allowing customers to use credit without worrying about accruing additional expenses.

Despite its relatively high interest rates and lack of rewards programs, the card is a smart choice.

So, this can be the best card for anybody trying to improve their financial status because of its emphasis on accessibility, flexibility, and affordability.

Weigh the pros and cons: should you get the Marbles Credit Card?

Do you think you need to learn more about this card to help you decide? If so, you can read this card’s pros and cons below.

We’ll help you see if this is the best credit card option for your financial needs at the moment!

Strengths and advantages:

- You’ll be able to check your eligibility to get this card with no credit score harm;

- This card allows you to have a chance to qualify even with a limited credit score;

- You’ll be able to use this card to build your credit score if you use it responsibly;

- You can choose the best payment date for your financial needs with this card;

- You’ll be able to feel safe with this card since it sends you text alerts to help you keep track of your account;

- You can get all of this card’s great features and pay no annual fee;

- Your credit limit will be reviewed in as little as three months after using your card responsibly.

Pay attention to some drawbacks:

- This card can have some relatively high-interest rates depending on your financial analysis and other factors;

- Unfortunately, this card doesn’t offer any regular rewards or welcome bonuses for new cardholders;

- You’ll need to pay late payment fees and fees if you go over the credit limit on your credit card.

Eligibility requirements: who can apply for the Marbles Credit Card?

Before you apply for this card, you’ll need to learn about the main requirements if has. So, first of all, you’ll need to be at least 18 years or over to qualify.

Moreover, you’ll need to have an income and be subject to other requirements during the application.

However, you’ll have a chance to qualify even if you have a not-so-good credit score!

Marbles Credit Card application process: the pathway to your new card!

You’ll be able to check your eligibility for this card in no time through the official website. So, you can go to the website and click to check your eligibility.

This way, you won’t need to harm your credit score to know if you have a chance to qualify for this card.

After that, you’ll need to provide the personal information and documents necessary and complete the application process.

Compare to conquer: is the Tesco Bank Foundation Credit Card a better pick for you?

If you’re looking for a different credit card option, we can help you learn about the Tesco Bank Foundation Credit Card!

This card can help you build your credit score with great features and a good initial credit limit!

Therefore, you can read our blog post below to learn more about this card and see how to apply!

Tesco Bank Foundation Credit Card review

Unlock the benefits of the Tesco Bank Foundation Credit Card – build credit, earn rewards, and enjoy a flexible credit limit!

Trending Topics

Halifax Clarity Credit Card review: Travel credit card!

Unravel the perks of the Halifax Clarity Credit Card - the ultimate companion for international travelers!

Keep Reading

Loans 2Go Personal Loan Review: no fees charged!

Are you prepared to witness your long-awaited plans turn into reality? If so, count on Loans 2Go on this journey! Click here to find out how!

Keep Reading

Tesco Bank Foundation Credit Card review: Earn Clubcard points!

Unlock the benefits of the Tesco Bank Foundation Credit Card – build credit, earn rewards, and enjoy a flexible credit limit!

Keep ReadingYou may also like

Moneyboat Loans Review: Quick Cash Without the Headache

Moneyboat Loans: Get fast cash with flexible repayment terms from 2 to 6 months. No perfect credit score required.

Keep Reading

NatWest Balance Transfer Credit Card review: No annual fee!

Navigate the credit landscape with insights into the NatWest Balance Transfer Credit Card. Our review delves into the card's unique features!

Keep Reading

TSB Platinum Purchase Credit Card: Your Key to Smart Shopping

Get the TSB Platinum Purchase Credit Card for smart shopping. Enjoy 15 months of interest-free shopping with this exceptional UK card!

Keep Reading