Finances

Understanding Your Credit Report: What Really Matters

If your credit report feels overwhelming, you’re not alone. This guide breaks down what really matters.

Advertisement

Stop Guessing: How to Understand Your Credit Report Properly

You check your bank account balance, but rarely glance at your credit report basics. Yet, hidden in those details, your financial profile shapes what lenders see and decide about you.

Credit report basics determine far more than loan approvals. Employers, landlords, and even utility providers sometimes study this information to make decisions. Knowing what truly matters allows you to keep control, not rely on luck.

This article demystifies the core features, offers actionable insight, and explores how your credit report basics influence your life. Start here to gain confidence and avoid common credit mistakes.

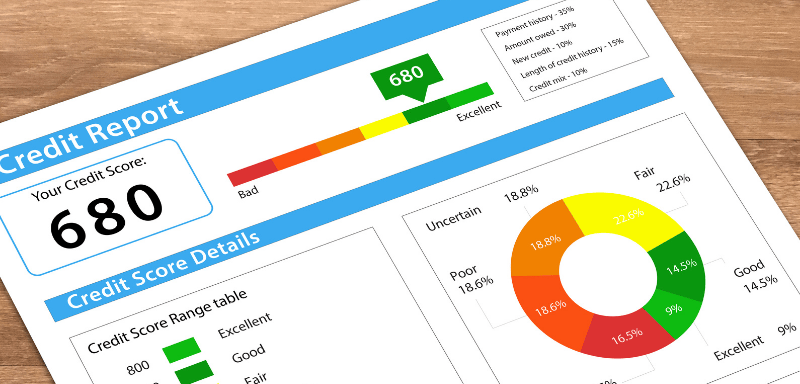

Identifying the Crucial Figures in Your Credit Profile

Your credit report basics directly affect your daily choices, so learning where specific figures come from unlocks smart money moves. Lenders see these numbers first, so you should too.

When you get a credit card bill or think about borrowing, the numbers on your credit report basics drive loan rates and access. Each entry shows something meaningful about your borrowing journey.

What’s Included: Key Data Breakdown

Credit report basics always list your full name, addresses, date of birth, and any aliases. If a detail is incorrect, you have the right to dispute it directly with the credit agency.

Your account history stands out. This section displays cards, loans, their activity, and payment records—think of it as your borrowing timeline, showing punctuality and reliability at every turn.

Searches—both hard and soft—are also tracked. Anyone viewing your credit can see if lenders made a check for lending or if you simply checked your own details recently.

Decoding Your Repayment Behaviour

On-time payment marks tell a clear story. Consistent punctuality signals stability, while late payments stick around for six years, reducing trust with new lenders immediately.

Arrears, defaults, and CCJs echo long after the date. A single missed bill lingers, while multiple unresolved records highlight ongoing risk, making it vital to keep debt in check.

Settled or closed accounts reflect the end of financial agreements. A settled account in good standing speaks to your reliability—think of it as a positive reference on your credit report basics.

| Key Element | Affects | Lender View | Action Step |

|---|---|---|---|

| Payment History | Score, Trustworthiness | Reliability | Pay on time every month |

| Credit Utilisation | Score, Flexibility | Responsibility | Keep usage under 30% |

| Defaults / CCJs | Access, Rates | Risk | Resolve quickly |

| Account Age | Stability | Experience | Keep old accounts open |

| Searches | Short-term Score | Enquiries | Avoid repeated applications |

What Lenders Really Use: Beyond the Simple Score

Lenders use credit report basics and more, not just a generic score. By reading into account behaviour, they decide if you’re low or high risk—small differences influence big decisions.

They check for stability in your address history and consistent repayments. Changes in job or address might trigger a closer review—bring documents if you move or change job recently.

Why Account Mix Strengthens Your Application

Mixing different credit types—credit cards, loans, even a mobile contract—demonstrates your ability to balance obligations. Lenders prefer applicants who handle varied payments smoothly and rarely max out available credit.

- Build a mix by accepting a credit-building card—use it for a recurring purchase, pay it off monthly, and your credit history expands without major risk.

- Add a small personal loan if you already have a card, but only if affordable—recording timely payments boosts credit report basics over time.

- If using Buy Now Pay Later offers, check they report to agencies. Regular repayments can help, but missed payments hurt.

- Consider utility accounts as credit. Some suppliers now report payment reliability, adding depth to your file with little extra effort.

- Don’t open several accounts at once. This looks desperate to lenders and temporarily lowers your score, which is highlighted in your credit report basics.

Check your report every four months for changes. This lets you catch issues early, question errors, or track whether account mix changes help over time.

Addressing Red Flags Before You Apply

Spotting red flags early in your credit report basics saves hassle and stops failed applications. Lenders react quickly to warning signs, so check before making applications.

- Dispute errors: If you spot someone else’s data or old defaults, contact the agency with clear evidence and demand removal.

- Update past addresses: Wrong addresses confuse lenders and raise fraud concerns, making applications harder.

- Settle outstanding debts: If there’s an old utility bill or parking fine, clear it before applying to show responsible behaviour now.

- Space out applications: Multiple hard searches signal risk—wait at least three months between each application for loans, cards, or mortgages.

- Add explanation notes: Use a Notice of Correction for temporary life events (job loss, illness) that affected payments—lenders read these before deciding.

Tracking these areas is an easy routine—set a calendar reminder every quarter to log on and review your credit report basics thoroughly.

Reading Your File with a Critical Eye

Analysing your credit report basics like a lender reveals hidden risks and identifies where improvements pay off. Use this skill to prepare for key financial steps, not just emergencies.

Scan for errors, unfamiliar accounts, or unexplained searches with care. Small mistakes, if left unchecked, can snowball into major setbacks if lenders read them poorly.

Comparing Report Agencies for Best Results

Three main agencies in the UK—Experian, Equifax, and TransUnion—hold your details. Each might show slightly different credit report basics, so it’s vital to check all three, not just one.

Look for discrepancies—an error on one report can be clean on another. If your Experian score drops but Equifax is stable, you can focus your effort where needed most.

Use this multi-agency overview before a mortgage or big application. Lenders might check different agencies, so prepping all three keeps surprises away and boosts your confidence instantly.

Spotting Patterns and Setting Action Plans

Patterns tell stories—maybe there are late payments clustered in winter, or searches spike every July before holidays. Use these clues to anticipate trouble before it damages your credit report basics.

Set alerts with free credit monitoring tools for repeat problems (like late payments or account openings you don’t recognise). Look for the ‘why’ behind each negative entry to address the source directly.

Make a short monthly note of changes. Track if your payment spacing, account use, or loan amounts are trending up or down—acting early avoids risk and reinforces positive change.

Common Misunderstandings About Credit Report Basics

Poor advice can harm more than help. Myths about credit report basics lead to habits that shrink opportunity and waste effort. Accurate learning means better financial outcomes, without anxiety or surprise.

Relying on untested tips (like closing old cards or applying repeatedly) risks harming your file. Check each tip with a credit agency’s official guidance before acting blindly.

Myth: Checking Your Own Report Hurts Your Score

Soft searches—like checking your own credit report basics—never lower your score. Lenders ignore these when deciding whether to issue credit, so regular monitoring is risk-free and crucial.

Some people hesitate to check their credit, fearing it looks bad. In reality, only hard searches matter; soft checks give you knowledge without any lender penalty.

Develop a routine: log in every three months to each credit agency’s website and download a copy. Spot issues early, keeping your credit report basics clean and healthy.

Myth: High Income Ensures a Good Report

Income doesn’t appear on your credit report basics—timely payment matters far more. People with high salaries sometimes miss bills, leading to poor records despite big pay packets.

Focus on regular, reliable payments, not just earning more. Your salary only enters discussions when applying for loans, setting your limit—not your score or report contents.

Treat maintaining your report the same as your current account—consistency and attention win, no matter your income or personal wealth.

The Impact of Credit Utilisation and Outstanding Balances

Credit utilisation—how much of your available credit you’re using—affects your credit report basics every month. Lenders love to see low balances and responsible limits, rewarding you with better deals.

Always keep usage under 30 percent of your total limit for peak scores. Exceeding this threshold triggers concern, so adjust spending or balance transfers as needed to stay in the safe zone.

Balancing Multiple Cards for Best Results

If you have several credit cards, divide spending rather than loading one card high. This shows lenders you use credit report basics wisely and avoid stressing a single account.

Suppose one card hits its limit but others stay at zero—lenders still worry. Spread purchases, keep each card under 30 percent, and pay down higher-interest cards first.

Review statements together, not separately, and plan repayments so your balances remain stable or gently falling month after month.

Clearing Balances Efficiently Raises Scores

A payment above the minimum each month does more than save on interest; it shrinks your utilisation on credit report basics, lifting your score with every pound paid off quickly.

Schedule repayments for payday. The moment you get paid, clear as much high-interest debt as possible—it’s easier to budget and avoids accidental late payments.

If you have unused credit, keep the account open but balance-free. It bolsters your available total, improving the percentage used and helping your score in line with credit report basics.

What to Do If You Find Errors or Identity Theft

Mistakes or fraud damages trust in your credit report basics. Immediate action prevents knock-on effects when lenders assess your next loan or credit application.

Request a correction from the relevant agency—provide clear evidence, like bank statements or correspondence, to speed up the fix. Follow up weekly until mistakes are removed, and set passwords for added safety.

Signs Your Report Needs Urgent Review

Unfamiliar accounts or sudden score drops indicate activity not your own. Act quickly—call your bank, freeze your card, and file a report with each credit reference agency immediately.

If you receive debt letters for loans or cards you never opened, this highlights fraud. Refuse responsibility, insist on investigation, and keep copies of all correspondence for future review of your credit report basics.

Agencies offer a fraud response team—Engage them as soon as you suspect an issue. This puts an alert on your file, making new credit much harder to open under your name.

When to Seek Further Help

If corrections take too long, escalate the case to the Financial Ombudsman Service—They can force corrections and remove harmful entries swiftly where credit report basics are compromised.

In severe cases, consult a debt advice charity for immediate steps. Explain what’s happened and follow their proposed actions to restore your file’s health quickly and thoroughly.

Check your report again after any fix—reconfirm that errors are truly gone and fraud markers removed, leaving your credit report basics as strong as possible for the future.

Building Long-Term Credit Health Habits

Forming reliable credit report basics habits pays off throughout life—from renting flats to securing business loans. Each small, repeated effort builds a bigger opportunity and financial peace.

Set a fixed date each month for checking payment due dates, reviewing your credit file, and budgeting next step—this turns good intentions into routine action with visible results on your report basics.

Automating Your Finances

Direct debits ensure every bill is paid on time, protecting the payment history in your credit report basics from slips caused by forgetfulness or busy schedules.

Group all payment reminders—rent, utilities, loans—into one app or sticky note. A weekly glance keeps you aware and in control, so nothing slips through undetected.

Linking spending alerts with your bank reduces surprises. When you’re close to overspending, you can adjust and avoid high credit utilisation in your credit report basics instantly.

Expanding Your File Without Big Risks

Tactically open new accounts if you only use one type of credit. For example, add a small mobile contract or catalogue card—use gently, repay quickly, and your credit report basics get a new positive entry.

Ask if friends can add you as an authorised user on established, healthy accounts. Their good history adds to your credit file, so the whole group benefits from responsible use.

Set mini-challenges—spend only cash for 30 days, or repay extra on your smallest balance. Each challenge makes healthy behaviour into a game instead of a chore, reflected in improved credit report basics over time.

Refining Your Credit Confidence: Takeaways and Next Steps

Reviewing credit report basics regularly arms you with power—fewer surprises and more options. You gain control, ready to seize opportunities by knowing where you stand.

Every adjustment—resolving errors, shaping a healthy account mix, improving utilisation—has immediate and long-term influence. Money habits now shape tomorrow’s borrowing options. Keep knowledge fresh, stay curious, and outsmart old advice.

Your credit report basics are not just pages of numbers; they’re your future access pass. Protect your standing, revise your strategies as life shifts, and enjoy the security that a well-managed file provides.

Trending Topics

HSBC Classic Credit Card review: discount program!

Find out all about the HSBC Classic Credit Card's features, usability, and benefits in our review. Click here to learn more!

Keep Reading

NatWest Balance Transfer Credit Card review: No annual fee!

Navigate the credit landscape with insights into the NatWest Balance Transfer Credit Card. Our review delves into the card's unique features!

Keep Reading

Everyday Loans Review: Up to £15000!

Find out about Everyday Loans' commitment to inclusivity and customer satisfaction. Explore their range of financial products!

Keep ReadingYou may also like

Halifax Clarity Credit Card review: Travel credit card!

Unravel the perks of the Halifax Clarity Credit Card - the ultimate companion for international travelers!

Keep Reading

Lloyds Bank Balance Transfer Credit Card review: Simplify Your Finances

The Lloyds Bank Platinum Balance Transfer Credit Card is a powerful tool for debt management. Check its features, fees, and how to apply!

Keep Reading

Types of credit cards: Exploring the Array of Options

Learn about the various types of credit cards available today, including cashback, travel rewards, and balance transfer cards!

Keep Reading